GBPUSD under increased downside pressure

Cable remains under increased pressure and heads south for the second straight day (down 1% in two days).

Persistent weakness in Britain’s business activity, increasing pace of cutting jobs and growing concerns about government’s finances, weigh heavily on sterling.

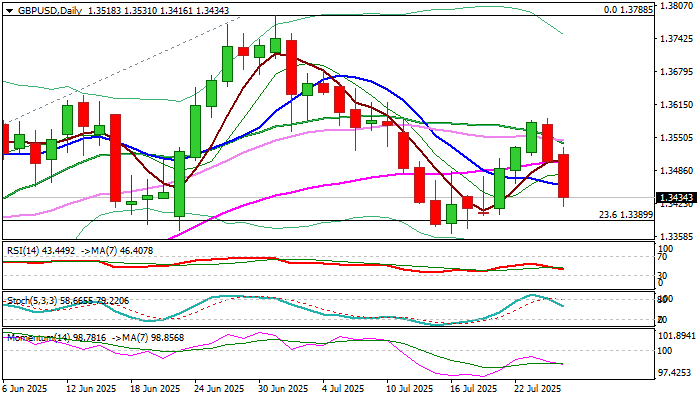

Pound accelerated sharply lower after repeated failure at strong technical resistance at 1.3576 (daily Kijun-sen / 50% retracement of 1.3788/1.3364 drop) with penetration of rising daily Ichimoku cloud (1.3476 – cloud top, reinforced by daily Tenkan-sen / 50% retracement of 1.3364/1.3588 recovery leg), adding to growing negative signals from MA’s being in bearish setup and strengthening negative momentum.

Bears eye key support at 1.3370 zone (lows of June 23 / July 16, near Fibo 23.6% of 1.2099/1.3788) which have created a higher base, break of which would spark fresh weakness on completion of asymmetric Head & Shoulders pattern on daily chart (1.3370 is also a neckline).

Res: 1.3458; 1.3500; 1.3544; 1.3588

Sup: 1.3370; 1.3321; 1.3300; 1.3250