Gold falls to three-week low as dollar benefits from US-EU trade deal

Gold continues to trend lower and extends drop from last week’s top ($3438) into fourth straight day on Monday.

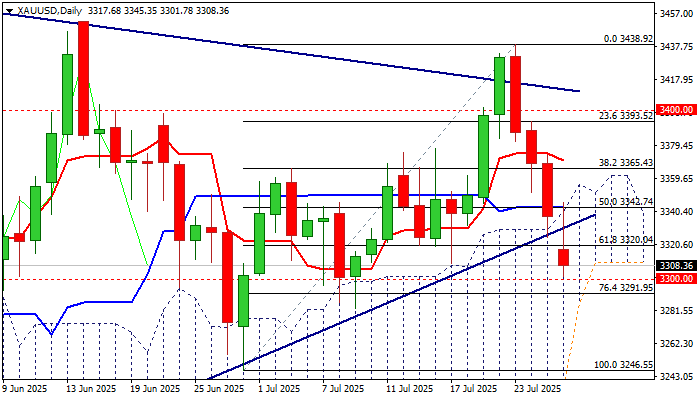

The metal’s price fell to the lowest in three weeks after US-EU trade agreement further lifted dollar, pushing gold through key supports at $3340 (daily cloud top) and $3330 (triangle support line), with fresh acceleration hitting levels just ticks ahead of psychological $3300 support.

Bears faced headwinds here (oversold conditions) but expected to remain in play if gold closes within the cloud and below triangle’s lower boundary today.

Fresh weakness pushed the price into the lower side of broader consolidation under new record high ($3500/$3120 range), but verification of new negative signal would require violation of $3300 (near the mid-point of the range) and cloud base ($3285) that would also avoid scenario of a false break out of triangle (last week’s short-lived violation of an upper triangle boundary).

The structure on daily chart weakened (MA’s turned to bearish setup, but 14-d momentum hovers at the centreline).

Focus shifts on Fed’s policy decision (due later this week) that would provide fresh direction signals.

Res: 3326; 3345; 3365; 3370

Sup: 3300; 3285; 3265; 3246