WTI Oil – bears hold grip ahead of Ukraine peace talks

WTI oil price returned to red on Monday following limited and short-lived support from US threats to India to stop buying Russian oil.

The oil price fell further and pressure the floor of near-term consolidation range that extends into fourth straight day ($61.94, the lowest in 2 ½ months).

Overall sentiment remains negative, following darkened economic outlook for developed economies and China’s unsatisfactory pace of economic growth that continues to overshadow the global demand outlook.

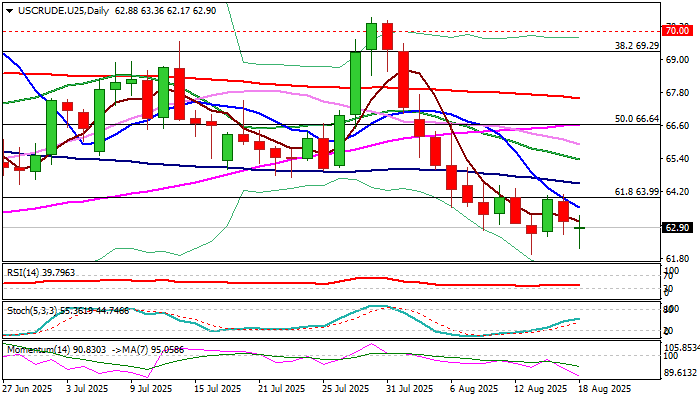

Daily technical studies remain in full bearish setup (near-term action additionally weighed down by the latest formation of 10/100DMA bear-cross and strengthening negative momentum) and signal that larger downtrend is intact.

Bears eye targets at $60.71 (Fibo 76.4% of $55.40/$77.88) and $60.00 (psychological / higher base of the second half of May), where stronger headwinds should be expected.

Markets await signals from today’s meeting between President Trump and Ukrainian President and separate meeting with leaders of some European countries, seeking for a peace solution for Ukraine.

Oil price could be deflated further in such scenario, though optimism among traders was so far cautious and limited.

Upticks should be capped under $64.00/50 zone (broken Fibo 61.8% / 100DMA) to keep broader bearish structure intact.

Res: 63.62; 64.00; 64.50; 65.38

Sup: 61.94; 61.24; 60.71; 60.00