Gold rises after Trump’s latest move to fire Fed Governor deepened uncertainty

Gold rose to two-week high on Tuesday, driven by fresh wave of risk aversion sparked by growing uncertainty on decision of President Trump to fire a Fed Governor Cook.

Trump’s conflict with the US policymakers is escalating again, after a campaign to remove Fed Chair Powell, which Trump eventually sidelined, but remained on track to secure dovish majority in the FOMC after failing to convince them for more radical rate cuts.

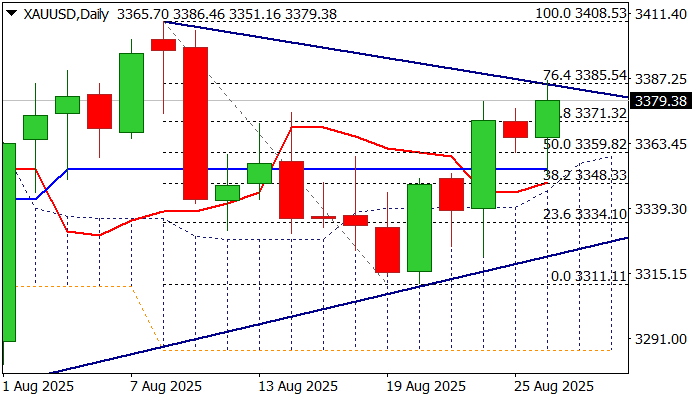

Fresh strength cracked important barrier at $3385 (upper triangle boundary / Fibo 76.4% of $3408/$331 bear-leg) but was so far unable to break higher.

Technical picture on daily chart is still mixed with positive signals from today’s formation of bullish engulfing pattern (still to be confirmed) and price action being underpinned by thick daily cloud, while neutral momentum studies and overbought Stochastic offset positive impact.

Repeated daily close above broken Fibo 50% ($3360) will be a minimum requirement to keep near-term bias with bulls, while close above $3371 (broken Fibo 61.8%) would boost optimism for push through triangle’s upper trendline and expose key resistances at $3400/08 (psychological / Aug 8 top).

Res: 3385; 3400; 3408; 3431

Sup: 3371; 3360; 3353; 3348