BTCUSD – holding below daily cloud base to keep bears in play for further weakness

BTCUSD is consolidating after a sharp fall in past three days (down over 6%), mainly driven by strong institutional selling.

The price edged higher after hitting six-week low today, although the upside remains limited and warning of persisting downside pressure.

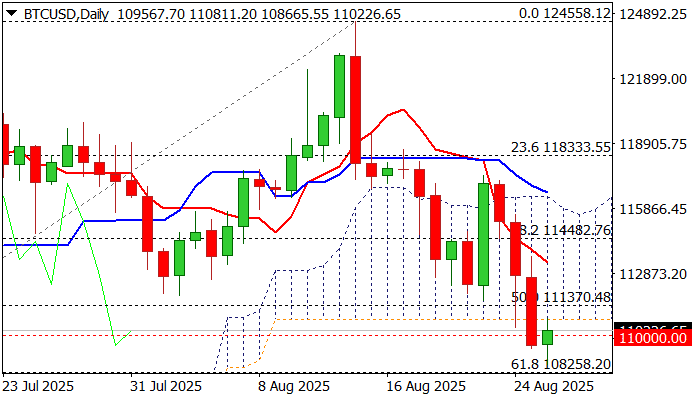

The latest fall broke through key supports at 111370 (50% of 98182/124558 rally / 100DMA), 110722 (base of thick daily cloud) and 110000 (psychological).

Violation of these levels generated strong bearish signal, with repeated daily close below, to validate signal and risk deeper correction from new all-time high.

Bears eye initial target at 108258 (Fibo 61.8%), with stronger acceleration to target 105097 (July 2 higher low) and 104407 (Fibo 76.4%).

Daily studies remain firmly bearish, with thick daily cloud weighing on price action, MA’s in full bearish configuration and very strong bearish momentum, with oversold Stochastic to partially counter pressure.

Ideally, consolidation should stay under the cloud, before larger bears regain full control again.

Only sustained break above 100DMA would diminish downside risk and allow for stronger correction of 117169/108665 bear-leg.

Res: 110000; 110370; 110772; 111634

Sup: 109379; 108665; 108258; 107419