GOLD – bulls crack critical $3400 resistance zone, US inflation data eyed for fresh signals

Gold keeps firm tone and cracks very significant $3400 resistance zone (psychological / Aug 8 peak), trading at the highest in nearly three weeks on Thursday.

Bulls are driven by uncertainty after President Trump’s attempts to fire Fed Governor and persisting tensions over potential replacement of Chair Powell, as well as expectations for Fed rate cut in September.

Although Chair Powel showed a dovish shift in his latest speech, he did not commit to any action in the near future, implying that coming economic data (US PCE index, due on Friday and August Labor report, due next week) will provide more details about inflation and condition in the labor sector and contribute to the central bank’s decision in September’s policy meeting.

While the fundamentals move into desired direction (PCE index is expected to keep steady rise by 2.6% in July, while recent strong drop in US employment and rise of unemployment) and contribute to rising bets for rate cut.

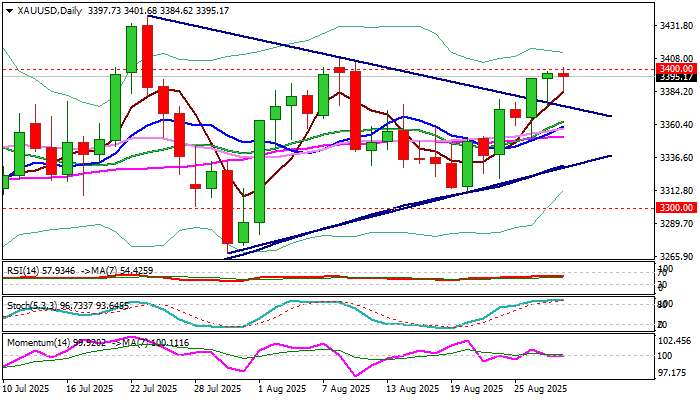

Technical picture remains predominantly bullish on daily chart (MA’s in full bullish configuration / break above triangle upper boundary / long tail of Wednesday’s daily candle) but positive signals are partially offset by strongly overbought Stochastic and flat 14-d momentum.

This implies that bulls will face difficulties to break critical $3400 zone, with consolidation likely to precede fresh push higher.

Broken Fibo 76.4% barrier ($3385) should ideally contain, with extended dips expected to find solid ground above broken triangle’s upper boundary ($3373) to keep bulls in play.

Firm break of key obstacles at $3400/08 to signal bullish continuation and expose targets at $3438/52 (tops of July 23 / June 16 respectively).

Res: 3400; 3408; 3438; 3452

Sup: 3385; 3373; 3367; 3356