Crude Oil remains under pressure from higher production and unexpected rise in crude stocks

WTI oil remains in red for the third consecutive day and holding near two-week low on Friday, deflated by signals that OPEC+ will announce further production increase in its meeting over the weekend and unexpected rise in US crude inventories.

Lower demand as US summer driving season ends, also contributed to weaker near-term picture.

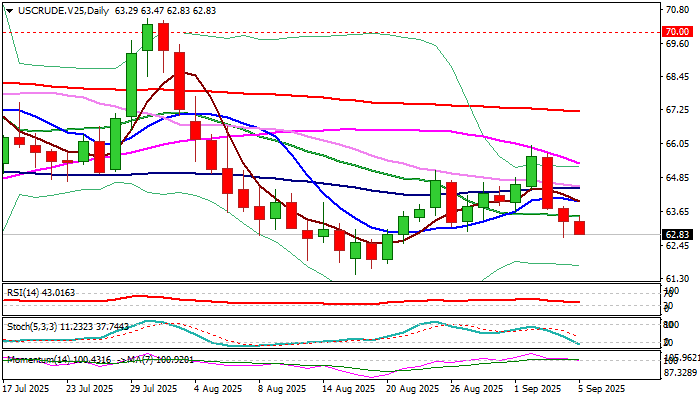

Oil is on track for a weekly loss after two weeks in green and probes again through cracked important Fibo support at $63.19 (61.8% of $61.44/$66.01 upleg), with firm break here to confirm fresh bearish signal for attack at $62.52 (Fibo 76.4%) and unmask key support at $61.44 (Aug 18 low).

Daily MA’s remain in full bearish setup, falling 14-d momentum is flirting with the centreline, which points to negative outlook, though some headwinds to be anticipated as Stochastic entered negative territory.

Broken 20DMA / 50% retracement $63.50/73 respectively) should ideally cap and keep immediate bears intact, also guarding first upper pivot at $64.38 (daily Tenkan-sen).

Res: 63.50; 63.73; 64.00; 64.48

Sup: 62.52; 61.82; 61.44; 60.71