AUDUSD – bulls hold grip, Fed expected to provide fresh positive signal

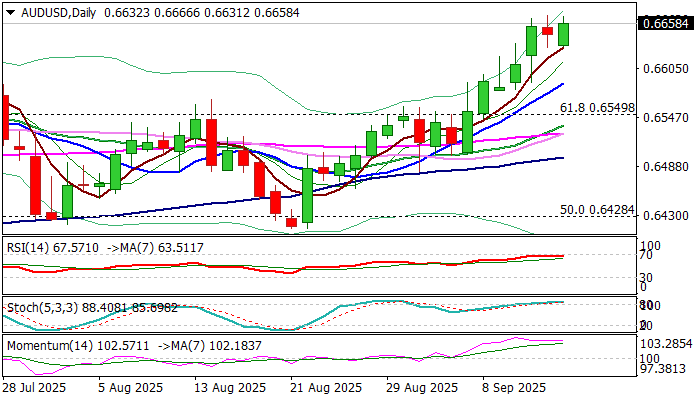

AUDUSD keeps firm tone and trades just under new 2025 high (0.6668) on Monday, in attempts to extend last week’s 1.4% advance (the biggest weekly gain since the third week of June).

Aussie dollar enjoyed strong support from weaker US dollar, anticipating Fed’s 25 basis points rate cut this week, with markets focusing on comments from Fed chief Powell which could provide more details about the central bank’s actions in coming months.

Bulls may accelerate if Fed keeps firm dovish stance, as markets started to speculate about possible 50 basis points cut and see potential for total cuts of 1% by early 2026.

Immediate barrier lays at 0.6675 (falling 200WMA), followed by 0.6700 (round figure / Fibo 76.4% of 0.6942/0.5914), violation of which to expose peaks of July/Aug 2024 at 0.6798 and 0.6823 respectively.

Technical picture on daily chart is firmly bullish, with the latest positive signal on formation of 20/55DMA bull-cross, additionally underpinning the action.

However, bulls may stay on hold for some time as daily stochastic is overbought and markets slowed the pace ahead of key decisions and signals from Fed.

Daily higher base at 0.6630 (lows on today / last Friday) and July 24 peak (0.6625) mark immediate supports, followed by rising 10DMA (0.6587) which should keep the downside protected.

Res: 0.6675; 0.6700; 0.6798; 0.6823

Sup: 0.6625; 0.6600; 0.6587; 0.6650