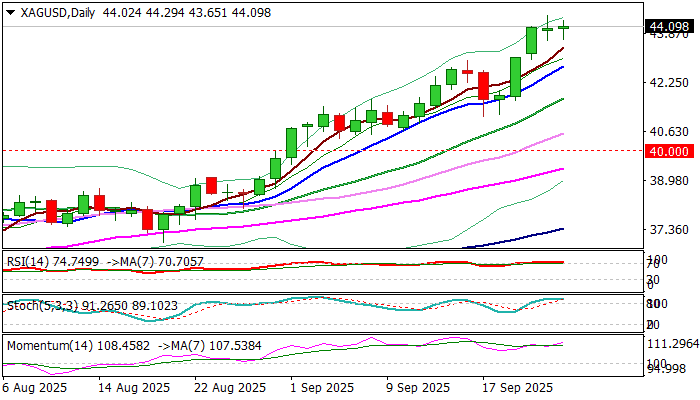

Silver – bulls take a breather under psychological $45 barrier

Silver price reduced pace after hitting new multi-year high ($44.46) on Tuesday but keeps firm bullish stance, lifted by recent rally in gold.

Tuesday’s Doji candle and Wednesday’s action, being so far in the same shape, signal indecision on approach to psychological $45.00 barrier.

Overbought conditions on daily chart suggest that bulls may take a breather for consolidation / shallow correction.

Higher base at $43.65 zone (Tue/Wed lows) offers immediate support with potential deeper dips to be ideally contained by rising 10DMA / 50% retracement of $41.11/$44.46 bull-leg) at $42.75 and keep bulls intact for fresh push higher, in the environment of strong positive sentiment.

Sustained break of $45.00 pivot to unmask Fibo projections at $45.51 and $45.94, along with nearby round-figure $46.00 resistance.

Alternatively, loss of $42.75 support would risk deeper pullback and expose targets at $41.70 (rising 20DMA) and 41.11/19 (Sep 17/18 higher base).

Res: 44.46; 45.00; 45.51; 45.94

Sup: 43.65; 42.75; 41.70; 41.11