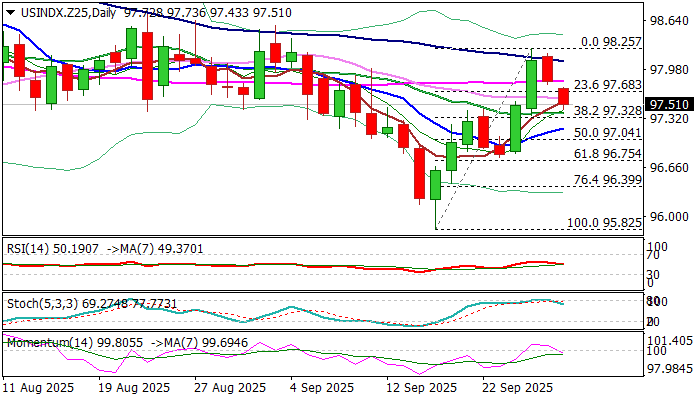

Dollar index – bears regain control after recovery failed at key technical barriers

The dollar index stays in red for the second day, pressured by concerns about potential US government shutdown and brightened outlook for Fed rate cuts that partially offset positive impact from last week’s upbeat US economic data.

The dollar reversed direction after failure to clear important technical barriers (thin daily cloud and 100DMA), where a bull-trap has formed.

Fresh weakness has so far retraced 38.2% of two-legged recovery from 95.82 (2025 low) and dented attempts of formation of Doji reversal pattern on weekly chart.

Weakening technical picture on daily chart (14-d momentum broke into negative territory / stochastic emerged from overbought territory, adds to bearish fundamentals and shows more space at the downside.

Sustained break of cracked 20DMA / Fibo 38.2% (97.41/32 respectively) to generate fresh bearish signal for extension towards 97.04 (50% retracement) and 96.80 (Sep 23 higher low).

Markets focus on key economic event this week – release of US Sep labor data that could offer more clues on Fed’s monetary policy path.

Res: 97.68; 98.08; 98.25; 98.56

Sup: 97.32; 97.04; 96.80; 96.40