GBPUSD extends steep decline on growing expectations for BoE rate cut

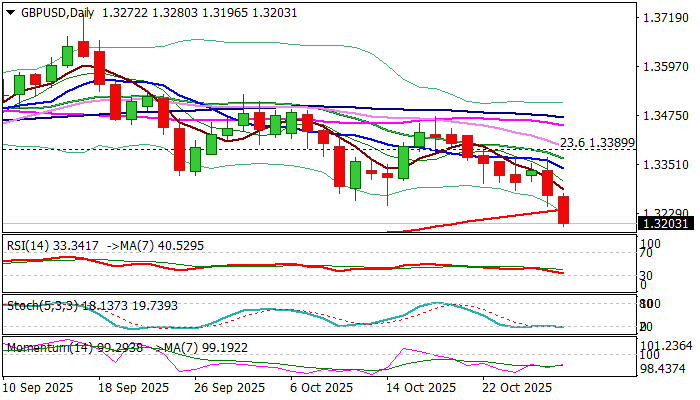

Cable hit three-month low on Wednesday, extending the steep bear-leg which emerged after strong upside rejection at daily cloud, into second consecutive week.

Fresh bears broke through important support provided by 200DMA (1.3239) and cracked 1.3200 level that unmasks key short-term support at 1.3141 (Aug 1 low (Fibo 38.2% of 1.2999/1.3788).

Today’s break of former low of Oct 14 (1.3248) generated another bearish continuation signal (continuation of larger downtrend from Sep 17 peak (1.3725).

Bears need close below 200DMA to open way towards 1.3141 pivot, break of which to complete bearish failure swing pattern on weekly chart and signal potential deeper correction of 1.2999/1.3788 (January – June uptrend) and expose psychological 1.30 support.

The notion is supported by daily MA’s now in full bearish configuration and strong negative momentum, from the technical perspective, while shift in fundamentals (growing expectations for BoE rate cut this year against previous forecasts for staying on hold until the end of the year) also contributes bearish near- term stance.

Broken 200DMA reverted to initial resistance, followed by session high / falling 5DMA (1.3280/85), which should ideally cap potential upticks and guard 10DMA (1.3342).

Res: 1.3239; 1.3280; 1.3300; 1.3342

Sup: 1.3162; 1.3141; 1.3100; 1.3000