USDJPY rallies to multi-month high in reaction to Fed / BoJ policy decisions

USDJPY jumped 1.2% in post-BoJ trading on Thursday and hit the highest since mid-February.

Fresh acceleration higher was sparked by unexpected Fed’s hawkish tone on Wednesday and extended after BoJ’s decision to keep rates on hold but signal potential hike if economy continues to move within projected parameters, which markets saw as cautious stance that further deflated yen.

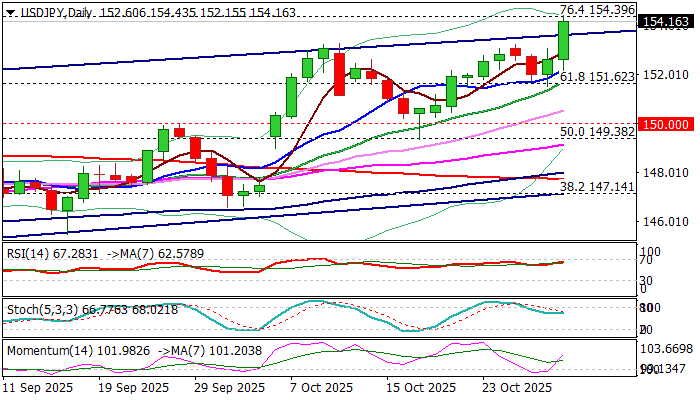

Bulls broke above bull-channel upper borderline (153.53), then took out 154.00 barrier (bear-trendline off 161.95, late June 2024 peak) and cracked Fibo resistance at 154.40 (76.4% 158.87/139.88 descend).

Bullish daily studies (strong positive momentum / MA’s in bullish configuration with the latest formation of 100/200DMA golden cross) underpin the action, with additional positive signal of acceleration of the larger uptrend, following lift above the bull-channel.

Violation of 154.40 to expose targets at 154.66/80 (Feb 12/13 double top) and psychological 155.00 level.

Daily close above broken bull-channel upper trendline to confirm signal and keep broader bulls fully in play.

Res: 154.40; 154.80; 155.00; 155.52

Sup: 153.53; 153.25; 153.00; 152.23