USDJPY – bulls pause for narrow consolidation, awaiting fresh direction signal

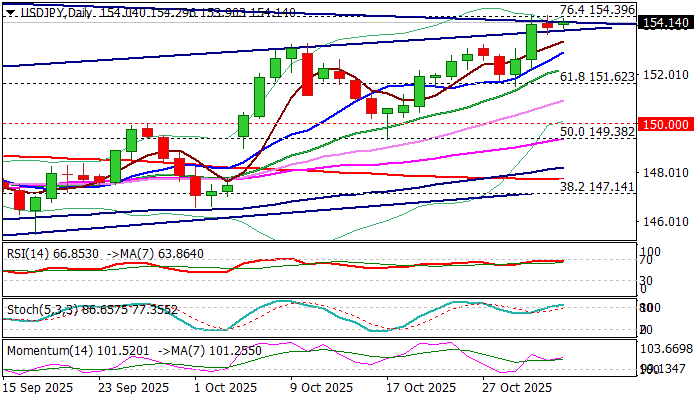

Bulls started to lose traction and the price moved into sideways mode in the last two sessions after strong post-Fed and BoJ acceleration broke above bull-channel upper boundary and above falling trendline connecting peaks of 2024 and 2025 but was repeatedly rejected at Fibo barrier at 154.40 (76.4% of 158.87/139.88 downtrend).

Overbought conditions slowed the action into narrow range, but bulls still firmly hold grip as the price stays above broken bull-channel upper boundary (reverted to support) but was unable to register close above cracked bear-trendline after two repeated attempts.

Technical picture remains firmly bullish on daily chart, although with initial warning from overbought stochastic and RSI moving sideways, just under the boundary of overbought territory.

Hourly studies turned neutral, with top of very thick hourly cloud (154.09) acting so far as very significant support.

I stay aside, awaiting direction signal, either on violation of broken channel line at 153.70 (initial, to be validated on extension below 153.25 (former tops) and 152.96 (daily Tenkan-sen).

Conversely, sustained break above 154.40 Fibo barrier to bring larger bulls back to play and generate initial signal of bullish continuation.

Res: 154.40; 154.70; 155.00; 155.57

Sup: 153.70; 153.25; 152.96; 152.23