USD INDEX eases further on rate cut expectations / stronger gold

The dollar index remains in red for the fourth consecutive day and extends the pullback that emerged after a failure to clearly break psychological 100 barrier and a bear trap at falling 200DMA, which reinforces the resistance.

Renewed expectations for Fed rate cut in December on optimistic view that the US economy remains resilient and inflation is not expected to rise significantly, as well as signs that the US government would reopen in coming days, continues to weigh on greenback, with fresh strength of gold price, adding pressure.

Traders, however, remain cautious and await release of a batch of US economic data, once the government reopens, which would provide a lot of information about the performance of the economy and have a clearer picture.

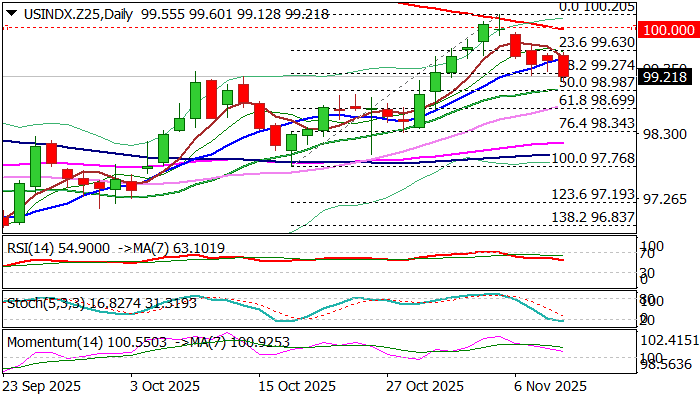

Fresh weakness broke below initial support at 99.51 (10DMA) and cracked Fibo 38.2% of 97.76/100.20 upleg (99.27) exposing more significant 99.00 support (50% retracement / 20DMA / round figure) violation of which to generate reversal signal.

Technical pictures are weaker on daily chart (converged 5/10 DMA about to form bear-cross / fading positive momentum), although more work at the downside will be required for bears to regain stronger control.

Near-term to remain biased lower while the price stays below 10DMA.

Res: 99.51; 99.64; 100.00; 100.20

Sup: 99.00; 98.69; 98.34; 98.00