USDJPY eases on verbal intervention

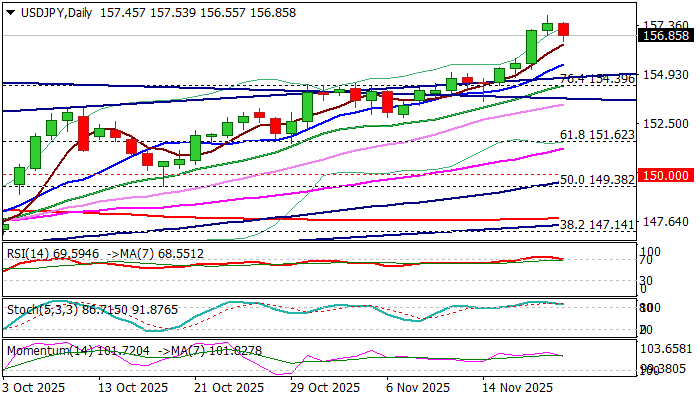

USDJPY eased from new ten-month high on Friday after the latest comments from top Japanese officials boosted expectations for intervention, as yen weakened significantly in past couple of weeks and came closer to the levels where the central bank last intervened.

Overbought daily studies also contributed to profit-taking, though pullback is unlikely to be deep (as long as prevailing market expectations that direct intervention will not occur while the pair stay below 160, remain in play).

The dollar remains firm in post-NFP time, on growing hopes that the Fed will keep interest rates on hold in the next meeting that supports the notion.

The price still holds well above first Fibo support at 155.88 (23.6% of 149.37/157.89) with deeper drop to face rising 10DMA (155.42) and expected to find firm ground above broken upper boundary of bull-channel (154.76) and Fibo 38.2% (154.63).

The pair is on track for strong weekly gain, although developing upper shadow on weekly candle warns that bulls might be losing steam, but larger bulls still hold grip and favor scenario of fresh push higher after limited correction, as there is still space until 160 level (possible trigger for intervention).

Res: 157.53; 157.89; 158.20; 158.87

Sup: 156.44; 155.88; 154.76; 154.63