Gold hits new multi-week high on Fed rate cut expectations / weaker dollar

Gold continues to trend higher and hit the highest in six weeks on Monday, supported by growing expectations for Fed rate cut in December.

Weak US economic data and recent dovish comments from Fed policymakers fuelled fresh rise in bets for further policy easing, while market participants also expect successor of Fed Chair Jerome Powell to hold more dovish stance.

Such environment contributed to further weakening of US dollar that boosts demand for yellow metal.

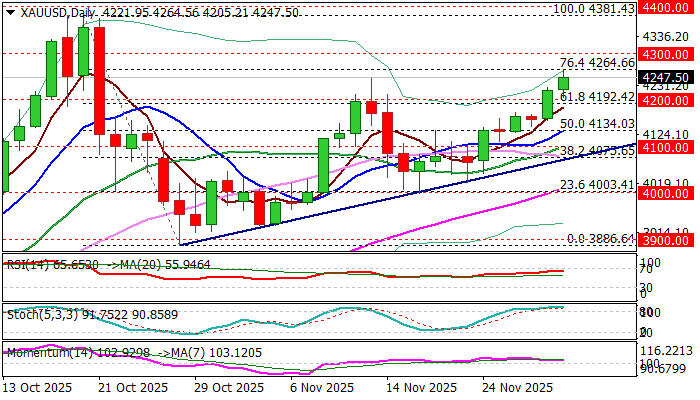

Fresh gains broke through previous high ($4245, close above which to confirm bullish signal) and cracked Fibo barrier at $4264 (76.4% retracement of $4381/$3886 correction), where bulls may face stronger resistance as stochastic is overbought and positive momentum faded on daily chart.

However, consolidation is likely to be narrow (overall picture is bullish and sentiment is positive) with $4200 zone (psychological / broken Fibo 61.8%) marking solid support which should keep the downside protected.

Firm break of $4264 Fibo barrier to strengthen near-term structure for test of $4300, the last significant obstacle en-route to $4381, new record high.

Res: 4264; 4300; 4339; 4368

Sup: 4200; 4173; 4134; 4100