GOLD – recovery extension above $5000 improves near-term picture and boosts optimism

Gold regained levels above $5000 on Wednesday as strong recovery extends into second consecutive day (metal was up almost 6% on Tuesday, in the biggest daily gain in years).

Brief pause in geopolitical stage (one of gold’s key drivers nowadays) which sparked the latest correction, is likely over as renewed tensions between the US and Iran revived safe-haven demand and lifted the price from dangerous zone.

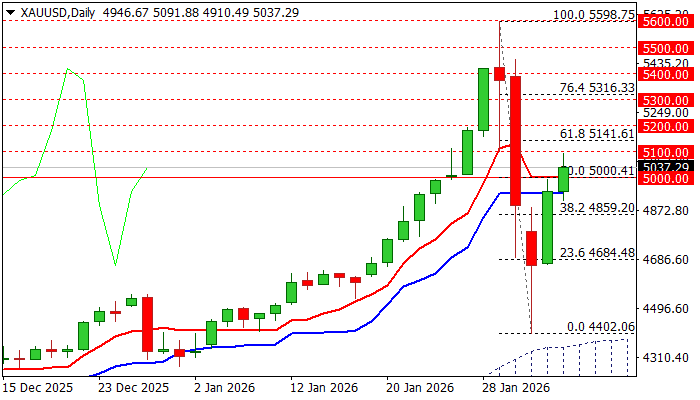

The situation on daily chart boosts optimism on signals about likely end of correction as pullback from new record high ($5598) repeatedly closed above Fibo 38.2% of $5598/$4402 ($4652) after spike lower found support above 50% retracement, reinforced by the top of ascending daily Ichimoku cloud.

This signaled a healthy correction of larger uptrend that provided better levels to re-enter bullish market, which subsequently accelerated recovery.

Technical picture improved as 14-d momentum bounced after reversal just above the centreline and RSI rose above 50 zone, while the price rose above daily Tenkan/Kijun-sen in bullish configuration.

Daily close above $5000 (psychological / 50% retracement / daily Tenkan-sen) is required to confirm bullish signal and keep fresh bulls intact for attacks at initial barriers at $5100/41 (round-figure / Fibo 61.8% of $5598/$4402), guarding $5314 (Fibo 76.4%).

Failure to sustain gains above $5000 would allow dips above $4936 (daily Kijun-sen) that would keep near-term bias with bulls.

Res: 5100; 5141; 5200; 5316

Sup: 5000; 4936; 4900; 4859