GBPUSD remains offered ahead of UK CPI data

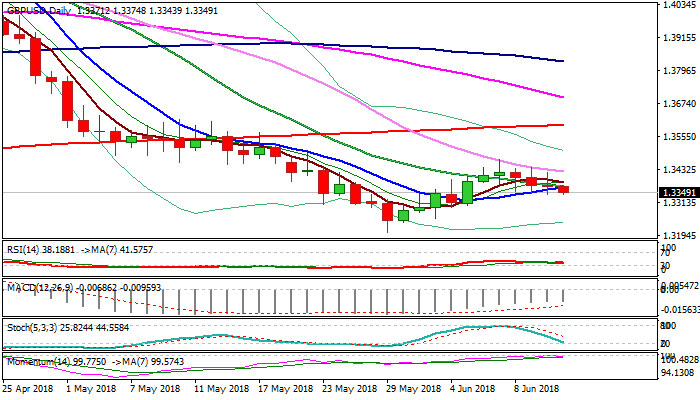

Cable holds in red for the fourth consecutive day and pressures lows of past two days at 1.3342, after eventual break below 10SMA (1.3368), also Fibo 38.2% of 1.3204/1.3472 upleg / 4-hr cloud top, which generated bearish signal.

Risk of break below 1.3342 pivots and extension of pullback from 1.3472 high is increasing, with the notion being supported by bearish configuration of daily MA’s and 14-d momentum entering negative territory.

Bears look for initial support at 1.3323 (4-hr cloud base), followed by 1.3306 pivot (Fibo 61.8% of 1.3204/1.3472 ascend, break of which would generate further strong bearish signal and risk extension towards the top of thinning weekly cloud (1.3237).

Falling 30SMA which limited recovery leg from 1.3204 and capped the action in past few sessions, marks key barrier at 1.3425, break of which is needed to shift near-term bias.

Key events for sterling today are UK CPI data and the second Brexit vote in parliament, while FOMC rate decision will be in focus in the US session.

Inflation in UK is expected to stay unchanged in May at 2.4% (annualized) and 0.4% (m/m).

Any surprise could generate strong signal for sterling, which could accelerate below 1.3300 on CPI miss.

Conversely, stronger than expected inflation data would further support expectations for Aug rate hike and boost pound.

Res: 1.3374; 1.3385; 1.3425; 1.3472

Sup: 1.3323; 1.3306; 1.3267; 1.3237