Post-Fed weak tone extends ahead of BoE decision

Cable dipped to new almost two-weeks low at 1.3067 in early European trading on Thursday, extending post-Fed weakness.

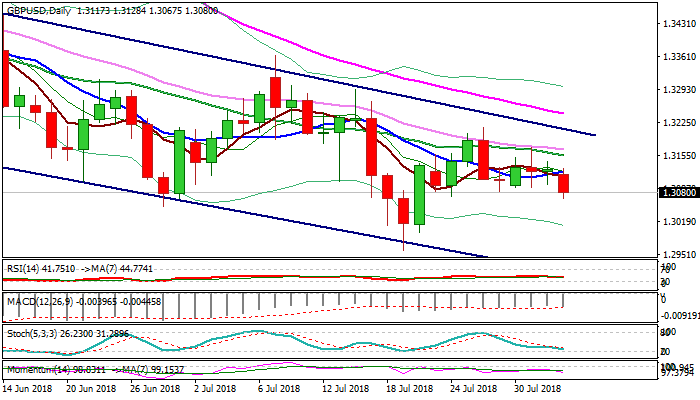

Probe through higher base at 1.3065 was initial bearish signal, as bearish configuration of daily techs suggests further easing.

The pair is awaiting decision from BoE today, which is likely to provide stronger signal.

Traders do not expect spectacular action after the central bank announces it verdict, but bears could be limited if BoE opts for widely expected ‘dovish hike’.

On the other side, pound could come under increased pressure on central bank’s unexpected decision to keep rates unchanged.

Initial barrier lays at 1.3122 (10SMA), followed by falling 20/30SMA’s (1.3155/68) and bear-channel upper boundary (1.3207).

At the downside, sustained break below 1.3085 base would open way towards psychological 1.30 level and key support at 1.2957 (19 July low).

Res: 1.3122; 1.3155; 1.3168; 1.3207

Sup: 1.3067; 1.3055; 1.3000; 1.2957