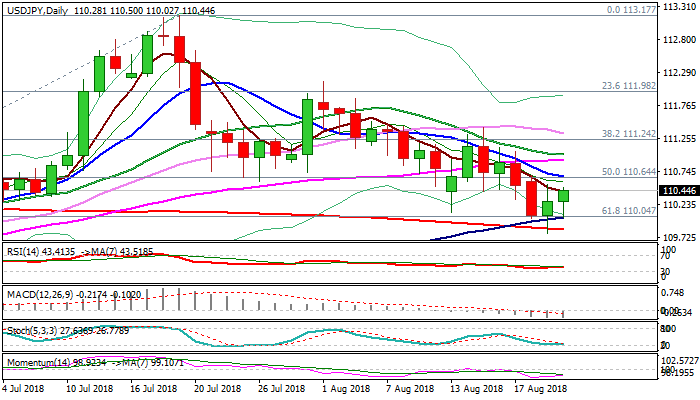

Near-term tone firmed but cloud base / 10SMA still cap

The greenback firmed in late Asian trading after being hurt by fresh political case in the US and retests daily cloud base 110.52, which capped Monday’s recovery attempts.

Barrier is reinforced by falling 10SMA (110.65), with firm break here needed to spark further recovery.

Daily MA’s are in mixed mode, while north-turning slow stochastic and momentum keep immediate focus at the upside.

However, near-term action remains without clear direction signal while the pair holds between falling 10SMA (110.65) and rising 100SMA (110.03).

Bullish scenario requires firm break above the upper pivots at 110.52/65 for extension towards 111.00 (20SMA), with reversal confirmation seen on lift above daily cloud top (111.29).

Conversely, loss of 100/200SMA’s (110.03/109.84) would signal extension of bear-leg from 113.17 (19 July high).

Res: 110.50; 110.65; 111.00; 111.29

Sup: 110.00; 109.84; 109.30; 108.90