Consolidation after strong four-day rally

The Euro is consolidating in early Wednesday’s trading, following strong bullish acceleration in past four days.

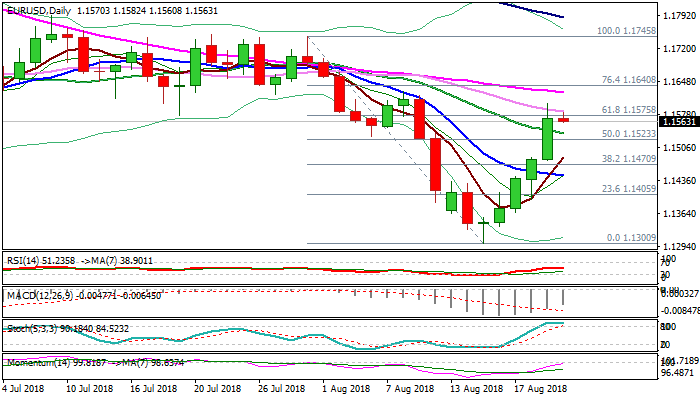

Rally from 1.1300 (15 Aug low) hit high at 1.1600 on Tuesday, but failed to close above falling 30SMA (1.1589) and Fibo 61.8% of 1.1745/1.1300 (1.1575).

Slow stochastic is turning south, deeply in overbought territory, signaling that consolidative / corrective phase may precede fresh upside, as strengthening momentum supports the notion.

Broken former strong resistances at 1.1540/36 (weekly cloud base / 20SMA) should ideally contain dips and keep bulls intact.

Close above 1.1575 Fibo barrier would generate bullish signal for extension towards 1.1625 (55SMA) and 1.1640 (Fibo 76.4%).

FOMC minutes are key event today and eyed for fresh signals.

Res: 1.1575; 1.1625; 1.1640; 1.1687

Sup: 1.1560; 1.1536; 1.1523; 1.1470