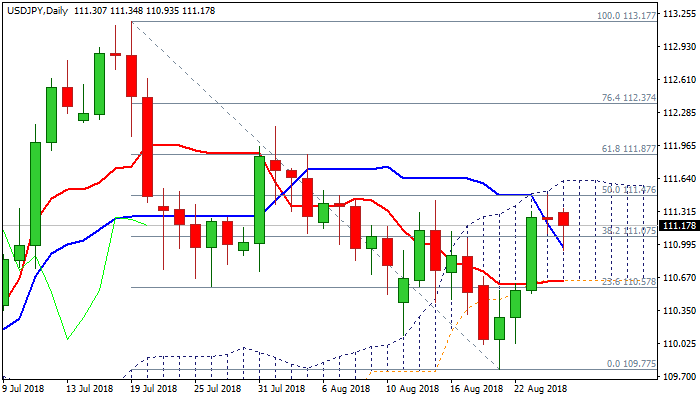

Hesitation at daily cloud top keeps risk of reversal in play

Early Monday’s action holds in red after last week’s three-day recovery rally stalled on approach to daily cloud top and Friday’s action ended in Doji candle, signaling bulls might be running out of steam.

The dollar came under pressure after Fed Powell’s speech in Jackson Hole last Friday disappointed many which expected more hawkish tone, instead of already known remarks about gradual rate hikes.

Also, weakening momentum and overbought slow stochastic add to negative signals.

Downside attempts were so far contained by converged 20/55SMA’s at 111.00 zone, keeping immediate downside risk limited.

Close below these supports would weaken near-term structure and confirm reversal pattern on daily chart, risking retest of key support at 110.64 (daily cloud base, reinforced by Tenkan-sen).

Conversely, bullish scenario requires break and close above daily cloud (cloud top lays at 111.62) to generate bullish signal for continuation of recovery rally from 109.77 (21 Aug low).

Res: 111.34; 111.62; 111.87; 112.15

Sup: 110.93; 110.78; 110.64; 110.51