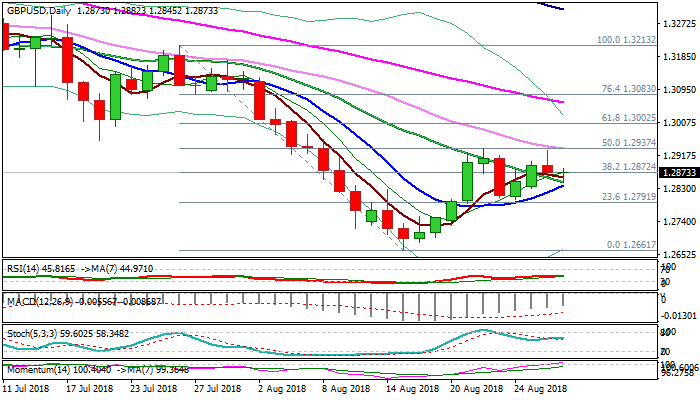

Extended consolidation after repeated rejection at 1.2935 pivots; 20SMA needs to hold dips

Cable bounced from session low at 1.2845 in early European trading, sidelining immediate downside risk on break lower.

Tuesday’s strong upside rejection at pivotal barriers at 1.2935 zone (double-Fibo, reinforced by 30SMA and daily Kijun-sen), which left bearish daily candle with long upper shadow, turned near-term bias negative.

Dips were contained by 20SMA (1.2845) which marks pivotal support and keeps alive hopes of fresh upside attempts.

Daily techs show mixed signals, as momentum continues to strengthen, but positive impact is partially offset by flat slow stochastic / RSI.

Bullish scenario requires sustained break above 1.2935 pivots to signal continuation of recovery from 1.2661 (15 Aug low).

Conversely, bearish signal could be expected on close below 20SMA, which would signal lower platform at 1.2935 and risk test of key near-term support at 1.2799 (24 Aug trough).

Res: 1.2882; 1.2900; 1.2935; 1.3000

Sup: 1.2845; 1.2836; 1.2799; 1.2766