USDJPY fresh bears probe below daily cloud base after report of US-Japan trade conflict

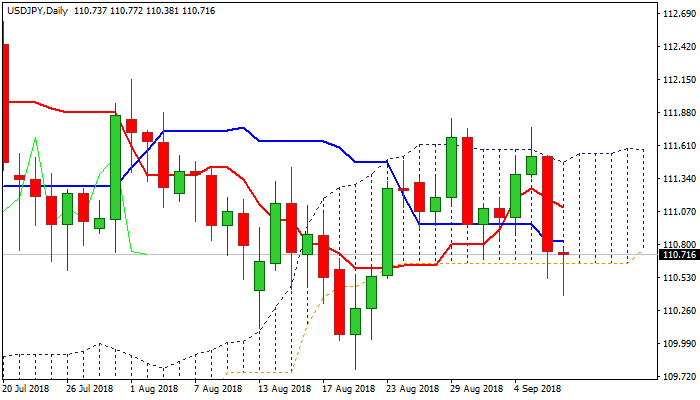

The pair holds in red on Friday and probed below daily cloud base (110.64), following strong fall on Thursday (down 0.69% for the day in the biggest one-day fall since 20 July).

The pair plunged on report suggesting that Japan would be the next country with which the US will open talks about trade issues.

Strong fall turned near-term focus lower after fresh bears weakened near-term structure and cracked strong supports at 110.64 (cloud base) and 110.51 (rising 100SMA), with Thursday’s long bearish daily candle weighing on near-term action.

Weekly close below thick daily cloud is needed to confirm bearish scenario and neutralize concerns about false break lower, which is so far in play and supported by strengthening momentum.

Firm break below cloud base would open way for renewed test of cluster of supports at 110.00/109.78 (psychological support / 200SMA / 21 Aug low) which contained 20/21 Aug attacks, with break here to generate strong bearish signal.

Conversely, close within thick daily cloud would sideline immediate bears and kept the pair in congestion, formed within daily cloud.

Us jobs data are in focus for fresh signals, with markets also awaiting further news about US / Japan trade issue.

Res: 110.77; 110.93; 111.13; 111.52

Sup: 110.64; 110.51; 110.38; 110.00