Oil price in tight consolidation after strong fall in crude stocks reduced bearish pressure

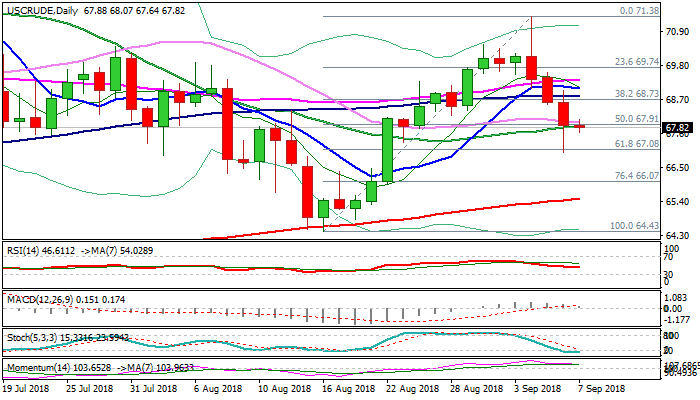

WTI oil is consolidating on Friday after three days of strong losses when the price fell from $71.38 (04 Sep spike high / strong upside rejection) to $66.99 (two-week low).

Turbulent situation in emerging markets and rising fears of escalation of global trade conflict, were the factors that keep oil price under pressure, with negative impact being partially offset by unexpected rise in US crude stocks (EIA report showed weekly crude inventories fell by 4.30 million barrels, falling well below forecast for 1.29 million barrels draw).

However, overall near-term structure remains negative, as daily techs are in bearish mode and fears that escalation of trade conflict could hurt global oil demand, keeping bearish bias in play.

Pivotal supports at $67.08/$66.99 (Fibo 61.8% of $64.43/$71.38 / Thursday’s spike low) remain in focus, with break here to generate bearish signal for extension of bear-leg of $71.38 towards next supports at $66.07 (Fibo 76.4%) and $65.50 (200SMA).

At the upside, a cluster of MA barriers between $68.81 and $69.31 marks upper pivotal points, break of which would neutralize downside threats.

Res: 68.81; 69.07; 69.31; 70.00

Sup: 67.64; 67.08; 66.99; 66.07