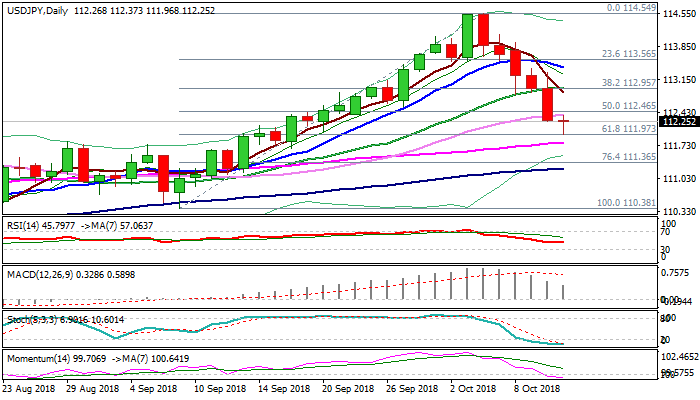

Bears consolidate above strong Fibo support at 111.97, awaiting fresh signal from US CPI data

Dollar’s steep six-day fall found footstep at important Fibo support at 111.97 (61.8% of 110.38/114.54 rally).

The pair is consolidating above new three-week low on Thursday, after the greenback suffered the biggest one-day losses since 06 Sep on Wednesday, after being surprisingly pulled lower by strong fall in US stocks.

Overall structure remains negative and reinforced by bearish sentiment, looking for fresh bearish signal on close below 111.97 pivot.

Continuation of downtrend from 114.54 would expose supports at 111.36 (Fibo 76.4%) and 111.24 (rising 100SMA).

Rising bearish momentum supports, but deeply oversold slow stochastic warns of consolidative/corrective action.

US CPI data are expected to generate fresh direction signal.

Res: 112.40; 112.95; 113.40; 113.56

Sup: 111.97; 111.78; 111.36; 111.24