Downbeat ZEW data softened near-term tone

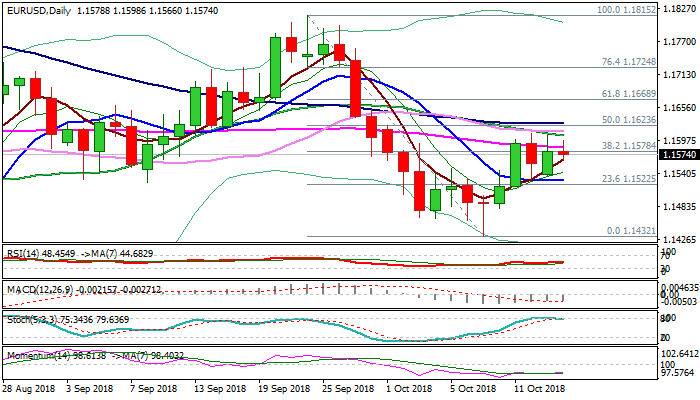

The Euro eased and probed through daily cloud top (1.1570) after disappointing ZEW data.

German economic sentiment weakened on fall well below expectations as Oct release at -24.7 (the lowest since July) strongly undershot forecast at -12.3.

Economic outlook for the European biggest economy was affected by rising concerns about failure of Brexit talks and escalating trade conflict between the US and China.

The Euro’s near-term action showed multiple upside rejections at 1.16 zone, despite weaker dollar, which increases risk of further losses, as downbeat data and recent election losses of German leading coalition, continue to weigh.

Adding to negative signals is reversal of daily slow stochastic from overbought zone; flat momentum, deeply in negative territory and daily MA’s (20/30/55) in bearish setup and capping upside attempts.

Return and close in the daily cloud would generate further negative signal and make the downside more vulnerable, with close below cloud needed to confirm bearish stance.

Alternative scenario requires sustained break above plethora of MA’s (1.1585/1.1627) to neutralize bearish threats and shift focus higher.

Res: 1.1585; 1.1606; 1.1627; 1.1668

Sup: 1.1566; 1.1545; 1.1531; 1.1518