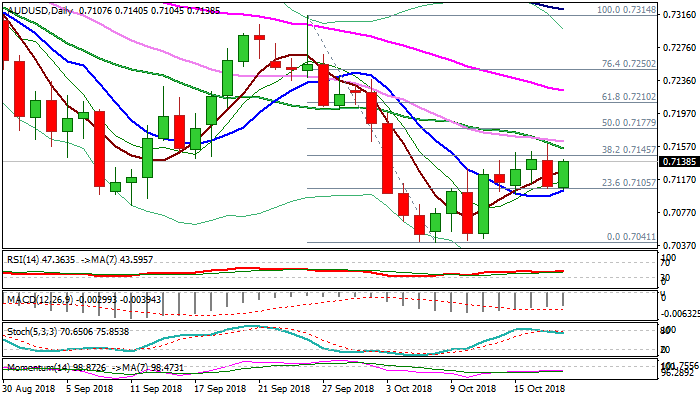

Aussie bounces from dangerous zone but faces strong obstacles

The Aussie dollar regained traction and bounced from lows at 0.7105 (Wed / today), reversing a part of previous day’s losses, after the greenback accelerated on hawkish Fed.

Strong unemployment data, released in early Asian trading (Sep 5.0% vs Aug 5.3% and f/c 5.3%) boosted Australian dollar, but fresh gains still hold below pivotal barriers at 0.7145/53 (cracked Fibo 38.2% of 0.7314/0.7041 / falling 20SMA).

Recovery from 0.7041 base was capped by falling 20SMA at 0.7159 on Wednesday, with repeated failures to close above 0.7145 Fibo barrier, signaling that bulls might be running out of steam.

Near-term price action is holding between rising 10SMA (0.7102) and falling 20SMA (0.7153) with break of either side needed to generate fresh direction signal, as mixed daily techs lack clearer signal.

Bullish scenario on sustained break of 20SMA would open way for recovery extension towards Fibo barriers at 0.7177 (50%) and 0.7210 (Fibo 61.8% of 0.7314/0.7041).

Break below near-term congestion floor / 10SMA would signal an end of corrective phase and re-expose 0.7041 base.

Overall bearish picture supports scenario.

Res: 0.7145; 0.7153; 0.7177; 0.7210

Sup: 0.7105; 0.7087; 0.7042; 0.7000