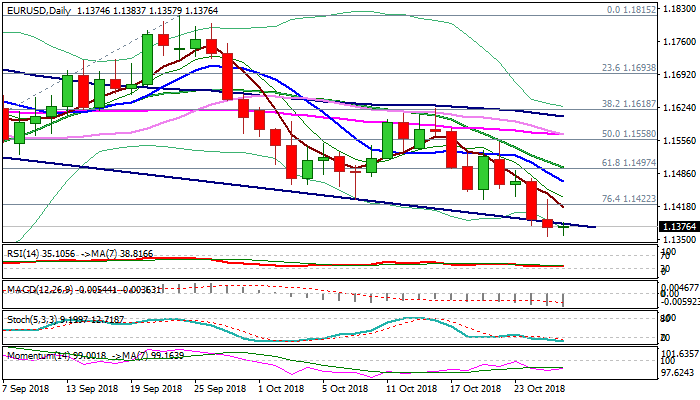

Bears eye targets at 1.1317/00 but consolidation may precede

The Euro consolidates within narrow range in early Friday, after two-day fall hit nine-month low at 1.1356 on Thursday.

The ECB left interest rates unchanged as expected, but central bank’s president Mario Draghi, in his balanced post-meeting comments, failed to convince investors that the ECB would start tightening in the second quarter of 2019, keeping the single currency under pressure.

Bears see no significant obstacles en-route to targets at 1.1317 (200WMA) and 1.1300 (15 Aug low), after negative signals were generated on break through 1.1432/22 pivots (former base / Fibo 76.4% of 1.1300/1.1815), as well as completion of asymmetric H&S pattern on daily chart, however, pre-weekend profit-taking and oversold daily studies could delay bears.

Broken 1.1432 base should cap upticks and guard falling 10SMA (1.1470).

Only rally and weekly close above 1.1497/99 (broken Fibo 61.8% / falling 20SMA) would sideline bears.

Res: 1.1384; 1.1422; 1.1432; 1.1470

Sup: 1.1356; 1.1335; 1.1317; 1.1300