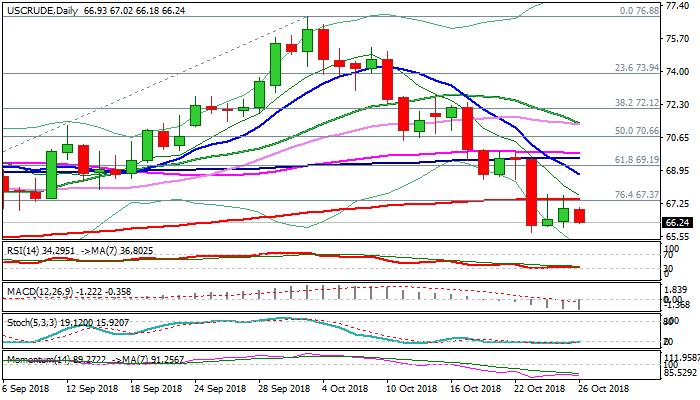

Broken 200SMA caps and maintains bearish tone

WTI oil holds in red on Friday and signaling that bears are returning to play after recovery attempts in past two days were repeatedly rejected after failing to sustain probes above strong 200SMA barrier ($67.46).

Rising concerns about global oversupply, despite the US sanctions on Iran which start at the beginning of November, keep oil prices under pressure.

WTI contract is on track for the third straight strong bearish weekly close, which adds to negative outlook, also supported by daily techs in firm bearish setup.

Bears eye target at $64.43 (16 Aug low), violation of which would expose another strong support at $63.66 (top of ascending thick weekly cloud).

Res: 67.02; 67.46; 68.73; 69.19

Sup: 65.73; 64.84; 64.43; 63.66