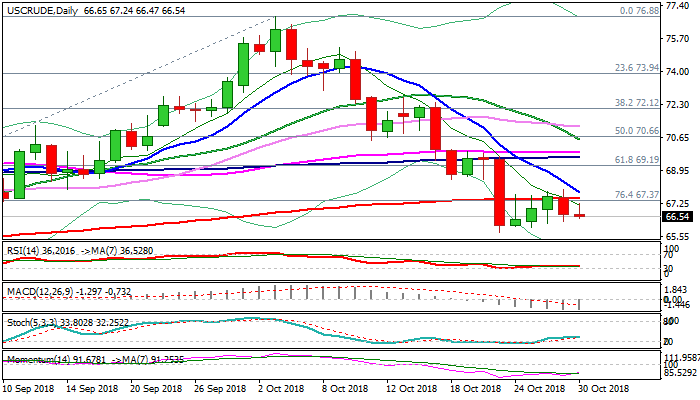

Bearish bias below 200SMA

WTI contract stands at the back foot on Tuesday, after recovery attempts were repeatedly capped by 200SMA ($67.50) and Monday’s pullback and close in red weakened near-term structure.

Persisting concerns that US / China trade conflict could escalate and slow demand and rising global supply despite Iran will be out in a couple of days when US sanctions kick, keep oil prices under pressure.

Recent bounce from new multi-week low at $65.73 was seen as correction of broader downtrend from $76.88 (03 Oct peak), before it resumes towards targets at $64.66 (top of rising weekly cloud / 16 Aug low).

Scenario is supported by strong bearish momentum and daily MA’s in full bearish setup, as falling 10SMA is approaching sideways-moving 200SMA in order to create a death-cross and reinforce bearish stance.

Release of US API crude stocks data, due later today, would provide fresh signal, as recent strong builds in crude inventories kept oil prices under pressure.

Repeated rise in crude stocks would reinforce bearish bias, while stronger draw would give bears a breather.

Only sustained break above 200SMA would sideline downside risk and allow for stronger corrective action and attack at daily cloud top (spanned between 68.58 and 69.55.

Res: 67.50; 67.80; 68.58; 69.55

Sup: 66.18; 65.73; 64.66; 64.43