Weak ISM data keep dollar at the back foot ahead of US jobs data

The pair lost traction and dipped further, extending pullback from Wednesday’s rejection at 113.33.

Broader dollar’s weakness on Thursday was boosted by weaker than expected US Oct ISM Manufacturing PMI (57.7 vs 59.0 f/c) and increase of jobless claims above forecast.

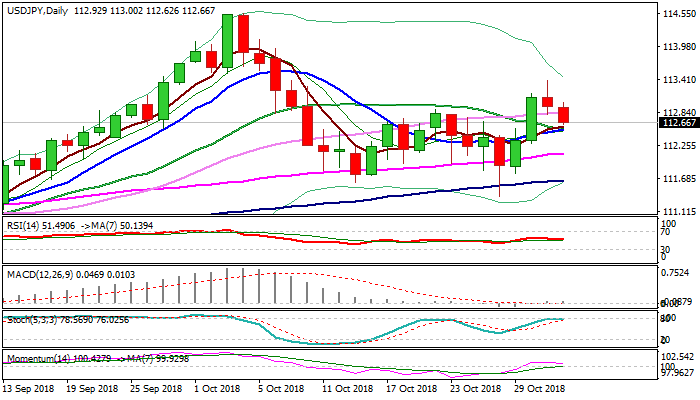

Fresh bears pressure key supports at 112.62/53 (Fibo 38.2% of 111.37/113.38 / converged 10/20SMA’s) with firm break here to further weaken near-term structure.

US NFP data are in focus as dollar’s fresh negative sentiment could be soured further if jobs data fall below expectations.

Markets are concerned about average earnings figure (0.2% f/c vs 0.3% prev) which could offset positive impact on strong NFP data and would risk extension towards Fibo 50% support at 112.38.

Scenario of both releases coming below expectations would open way for extension through key supports at 111.65 (100SMA) and 111.37 (26 Oct low).

Conversely, upbeat NFP and earnings would boost the greenback for advance above 113.38.

Res: 112.82; 113.00; 113.33; 113.80

Sup: 112.53; 112.38; 112.13; 111.65