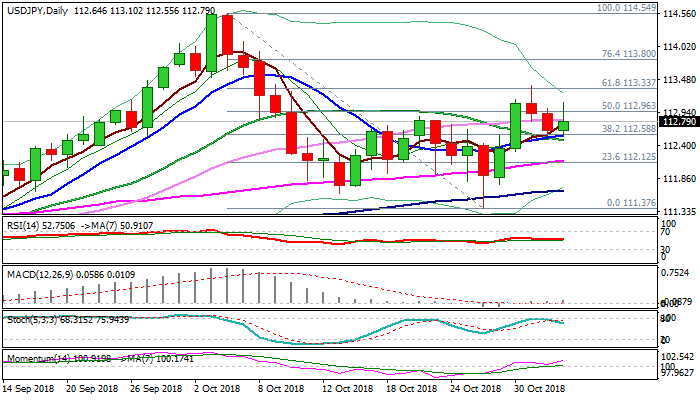

Bullish bias above 10SMA; US NFP eyed for fresh direction signal

The pair jumped to 113.10 high in late Asian trading on Friday, in recovery attempt after two-day pullback and today’s action were contained by rising 10SMA (112.55) which also created a bull-cross with 20SMA.

But gains were so far short-lived, as the price returned below 113 handle, awaiting US jobs data which could provide fresh direction signal.

Safe-haven yen slipped after signals of easing US/China trade tensions, keeping pair’s overall bullish bias, but looking for a catalyst, which could be provided by US data.

Strong bullish momentum on daily chart supports, however, mixed signals from daily MA’s and slow stochastic lack clearer signal.

Positive US jobs data could spark acceleration through pivotal 113.33 barrier (cracked Fibo 61.8% of 114.54/111.37) and open way for further advance.

On the other side, negative signal could be expected on weekly close below 10/20SMA, which would expose initial target at 112.17 (rising 55SMA) and would risk extension towards 100SMA (111.67) on stronger bearish acceleration.

Res: 112.96; 113.10; 113.33; 113.80

Sup: 112.55; 112.30; 112.17; 111.67