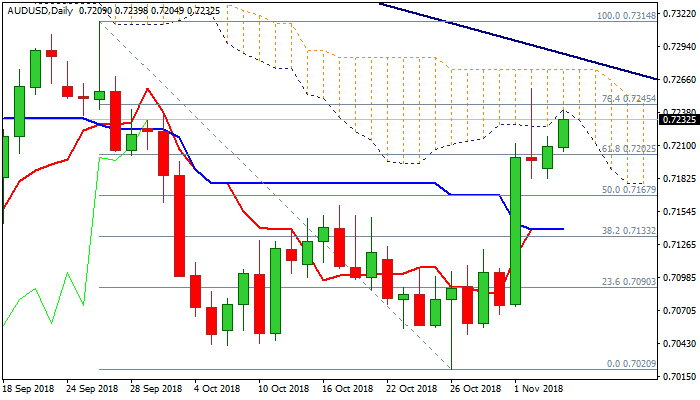

Sentiment remains positive despite unchanged RBA; fresh advance faces headwinds from falling daily cloud

The Australian dollar stands at the front foot and attacks daily cloud base (0.7241) in extension of Monday’s rally.

Bulls regained traction in European session after mild reaction on RBA in Asian trading, when the pair traded within 15-pips span after release.

The central bank kept interest rates unchanged at 1.5%, as expected, with the following statement showing no significant changes from the one in October.

Slightly improved RBA’s growth forecast, boosted the sentiment, which resulted in acceleration towards cloud base, where the pair faces strong headwinds after last Friday’s strong upside rejection.

Daily techs maintain strong bullish momentum and support the advance, which requires penetration of daily cloud and extension through falling 100SMA (0.7265) for fresh bullish signal, with lift and close above cloud top (0.7274) and trendline resistance (0.7285), needed to confirm bullish scenario.

On the other side, repeated rejection under falling daily cloud would weaken the sentiment, with return below broken falling 55SMA (0.7174), to shift near-term focus lower.

Reaction on results of the US midterm election could be pair’s key driver today.

Res: 0.7241; 0.7258; 0.7265; 0.7274

Sup: 0.7204; 0.7174; 0.7159; 0.7128