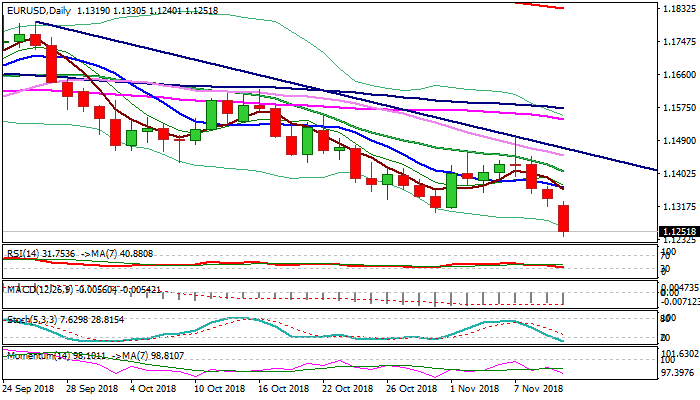

Eventual break below key 1.1300 zone supports risks extension towards 1.1186/09

The Euro hit the lowest levels since late June in early Monday’s trading, as strong bearish acceleration at the beginning of the week broke below key supports at 1.1311/00 (200WMA / 15 Aug / 31 Oct lows).

Stepp fall after strong upside rejection at 1.1500 zone last week extends into fourth straight day, as the greenback maintains strong bullish bias and the single currency was also hit by rising concerns over Italy’s budget, which was rejected by the EU last month and Rome needs to present revised version of the budget by tomorrow.

Adding to negative tone was EU’s cut of forecasts for Italian growth last week.

Increased pace of decline and break below key 1.1300 zone supports, sees risk of extension towards next pivotal support at 1.1186 (Fibo 61.8% of 1.0340/1.2555 ascend), violation of which would expose higher base at 1.1118/09 (20 Jun / 30 May 2017).

Daily techs are in full bearish setup and support further weakness, with oversold slow stochastic / RSI, suggesting that bears could be interrupted, but so far without firmer signals.

Broken supports at 1.1300/11 now mark strong barriers which are expected to ideally cap upticks.

Res: 1.1300; 1.1311; 1.1330; 1.1366

Sup: 1.1240; 1.1226; 1.1186; 1.1109