Recovery stall on approach to key Fibo barrier; weak German data and Italy budget story weigh

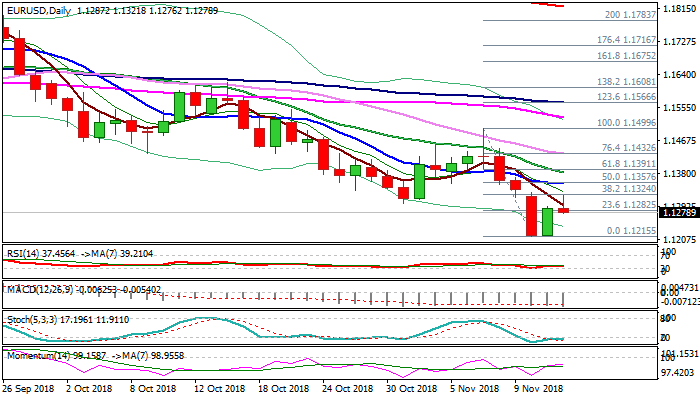

Recovery Mon/Tue double-bottom at 1.1215 shows signs of stall as early Wednesday’s extension of previous day’s rally lost the steam on approach to pivotal Fibo barrier at 1.1324 (38.2% of 1.1499/1.1215 bear-leg.

Data released earlier today showed that German economy contracted in Q3, adding to negative signals on Italy’s budget and fears of negative impact from trade conflict to the global growth, which keeps the Euro under pressure.

Focus turns on release of bloc’s Q3 GDP data today, which could provide fresh boost on better that expected results.

Near-term outlook remains negative as daily techs are bearish and lacking momentum for stronger recovery.

Fears of recovery stall and fresh acceleration towards key supports at 1.1215 (the lowest since June 2017) would remain strong while Fibo barrier at 1.1324 stays intact.

Conversely, break above 1.1324, would provide relief, but stronger bullish signal could be expected on break and close above falling 10SMA (1.1353).

Res: 1.1300; 1.1324; 1.1353; 1.1382

Sup: 1.1276; 1.1252; 1.1215; 1.1186