Aussie eases after recovery stalled on fading optimism over possible US/China deal

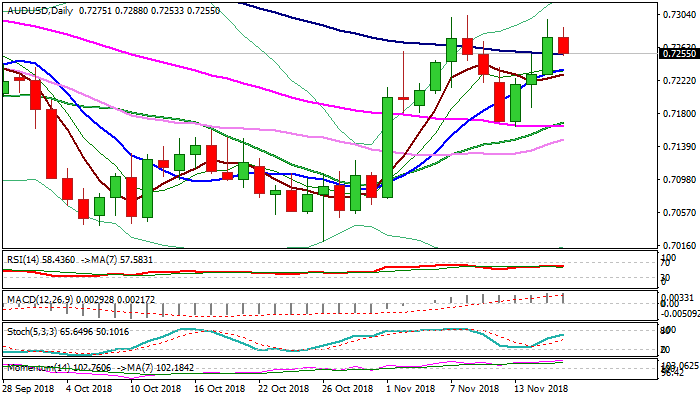

The Australian dollar holds in red on Friday and eases after three-day rally which resulted close above falling daily cloud and main bear-trendline which tracks the downtrend from 2018 high.

Bulls are running out of steam and stalled on approach to key barriers at 0.7302/14 (08 Nov / 26 Sep highs) as hopes on US/China deal which fueled recent rally started to fade.

On the other side, daily techs maintain strong bullish momentum and MA’s created a number of bull-crosses, remaining supportive for further advance.

Weekly close above broken trendline resistance would provide additional bullish signal, which needs confirmation on sustained break above 0.7302/14 pivots to signal continuation of recovery phase and also generate stronger reversal signal of 10-month downtrend.

Today’s easing so far holds above key supports at 0.7250 zone (broken trendline / daily cloud top) which need to contain dips and keep bullish bias.

Negative scenario on return and close below these supports signal another false break above cloud top / bear-trendline, which would weaken near-term structure.

Res: 0.7288; 0.7302; 0.7314; 0.7374

Sup: 0.7247; 0.7225; 0.7188; 0.7164