Rising safe-haven demand keeps dollar under pressure; Friday’s massive bearish candle weighs

The pair is consolidating within daily cloud on Monday, after 0.67% fall last Friday, when comments from Fed official Clarida shook expectations for rate hike in Dec and prompted investors into safe-haven yen, sending the dollar sharply lower.

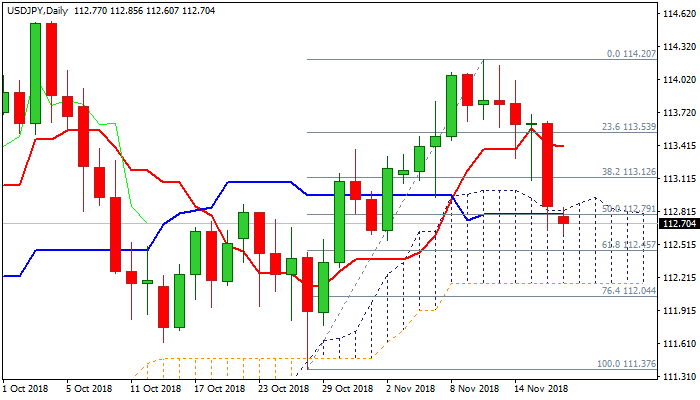

Dollar’s biggest one-day fall in Nov hit the lowest since 02 Nov and penetrated thick daily cloud (cloud top lays at 112.82) but failed to close in the cloud on Friday.

Fresh weakness on Monday holds in the cloud and was so far capped by cloud top, now reverted to resistance.

Weakening daily studies (10;20;30SMA’s turned to negative setup and bearish momentum is strengthening) support near-term bears, along with weekly bearish engulfing.

Friday’s big bearish daily candle weighs as fresh bears cracked rising 555SMA (112.68) and look for next pivot at 112.45 (Fibo 61.8% of 111.37/114.20 upleg) to confirm reversal from 114.20 and expose next key supports at 112.16/04 (daily cloud base / Fibo 76.4% / 100SMA).

Persisting concerns about US/China trade conflict and fears about slowing global growth keep risk-off mode and maintain pair’s negative near-term bias.

Res: 112.84; 113.08; 113.52; 114.00

Sup: 112.60; 112.45; 116.16; 112.04