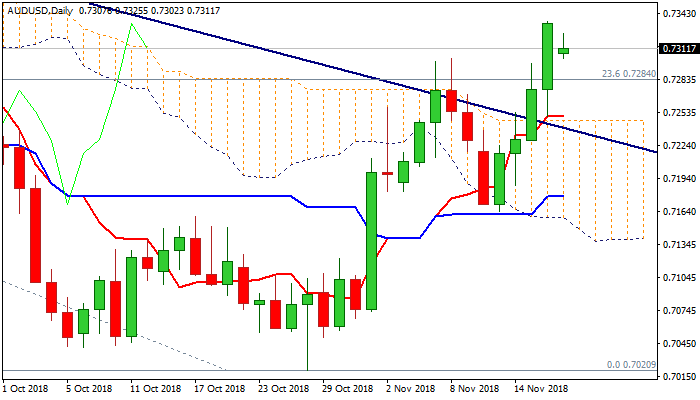

Bulls pause on soured US-China relations but remain in play above daily cloud

The Australian dollar attempts to consolidate after gap-lower opening on Monday on soured relations between the US and China, over weekend’s APEC meeting.

Higher Asian stocks helped Aussie to regain some ground but was unable to fill the gap so far.

The pair rallied strongly last week (up 1.6% for the week) and gained strong bullish signals on weekly close above trendline resistance, which further boosted developing reversal signal.

Negative impact on news could be short-lived, but profit-taking after last week’s strong rally could spark deeper correction.

Momentum studies on daily chart turned south and slow stochastic is overbought, adding to correction signals.

Deeper pullback needs to hold above strong supports at 0.7250 zone (converging 10/100SMA’s / daily cloud top) to keep bulls in play for fresh upside.

Friday’s high at 0.7335 marks initial barrier, followed by 0.7381 (lower top of 21 Aug) violation of which would expose key Fibo barrier at 0.7446 (38.2% of 0.8135/0.7020 fall).

Negative scenario requires close below 0.7250 pivots to weaken near-term structure and risk deeper fall.

Res: 0.7335; 0.7381; 0.7445; 0.7465

Sup: 0.7302; 0.7250; 0.7235; 0.7215