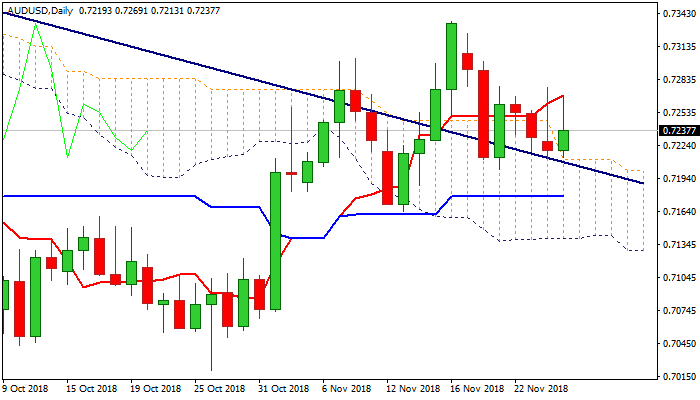

The downside remains vulnerable while 0.7270/80 zone pivots cap

The Aussie dollar holds bid tone on Wednesday, despite stronger greenback and downbeat Australian data released earlier today (Q3 Construction work done -2.8% vs 0.9% f/c).

The pair holds above top of falling thick daily cloud which marks significant support at 0.7211, with strengthening momentum and north-turning slow stochastic on daily chart, being supportive for further recovery.

On the other side, strong upside rejections in past two days that left daily candles with long upper shadows, suggest that recovery attempts are lacking strength and keep the downside vulnerable.

Selling upticks into 0.7270 zone (Mon/Tue highs, reinforced by daily Tenkan-sen) remains favored for renewed attack at cloud base.

Sustained break into daily cloud would generate bearish signal, which would require confirmation on break below 0.7178 (55SMA / 50% of 0.7020/0.7335 rally).

Conversely, close above 0.7270/80 barriers would neutralize bearish threats and shift focus higher.

Res: 0.7242; 0.7253; 0.7276; 0.7300

Sup: 0.7222; 0.7211; 0.7199; 0.7187