Bulls show hesitation at 1.1393 Fibo barrier but keep focus at the upside

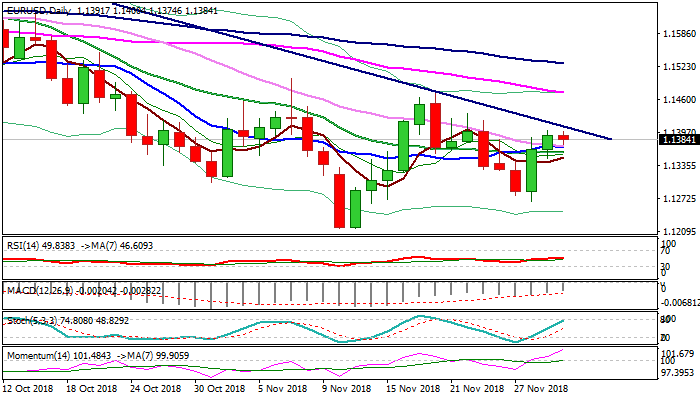

The Euro consolidates under new one week high at 1.1401 in early Friday’s trading, as strong two-day rally is taking a breather after failing to close above cracked pivotal Fibo barrier at 1.1393 (61.8% of 1.1472/1.1267) on Thursday.

Near-term structure remains bullish and maintains strong momentum, but requires sustained break above 1.1393 to open way towards initial barriers at 1.1404 (trendline resistance) then 1.1423/33 (Fibo 76.4% / 22 Nov high) and unmask 1.1472 (20 Nov high / 55SMA).

Weak German retail sales (Oct -0.3% vs 0.4% f/c) impacted immediate bulls, with EU CPI (Nov y/y 2.1% f/c vs 2.2% prev) being the highlight of European session and speech of Fed’s Williams focused in American session for fresh signals.

Supports at 1.1360/55 (20SMA / top of thick hourly cloud) are expected to ideally contain dips and maintain bullish bias, while extended downticks would put bulls on hold.

Weekend’s Trump / Xi meeting is the key event and expected to provide strong direction signals.

Res: 1.1404; 1.1433; 1.1472; 1.1500

Sup: 1.1360; 1.1334; 1.1318; 1.1299