Spot Gold at one-month highs on weaker dollar

Spot gold advanced 0.75% since Monday’s opening and hit new nearly one-month high at $1232, advancing on weaker dollar after US/China trade ceasefire deal.

The yellow metal regained traction after Thu/Fri rejection on both direction, which signaled indecision as markets were awaiting signals from G20 meeting.

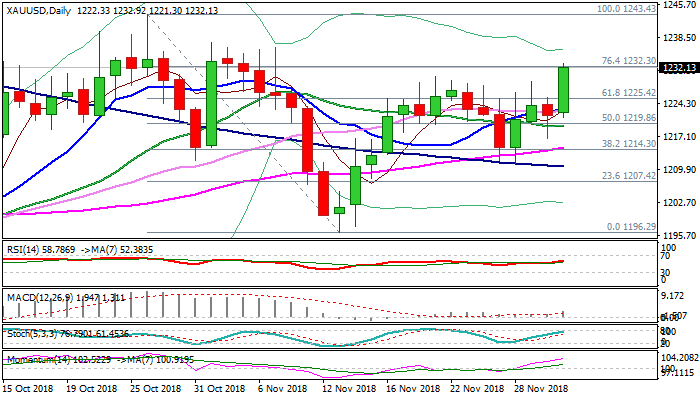

Fresh advance emerged from European session correction low at $1229 and probe again above $1232 (Fibo 76.4% of $1243/$1196 descend), for test of $1235 (50% $1309/$1160) and lower platform at $1236 zone, violation of which would expose 26 Oct spike high at $1243.

Gold is on track for the biggest one-day gains since 01 Nov on renewed bullish sentiment, with firmly bullish daily studies supporting scenario.

former high at $1230 marks immediate support, followed by broken Fibo 61.8% barrier now reverted to support ($1225), with stronger dips expected to hold above 10/30SMA’s ($1223/22) which formed bull-cross.

Res: 1232; 1235; 1236; 1243

Sup: 1230; 1225; 1222; 1219