Aussie eases as weak Chinese data hurt the sentiment; NFP in focus for fresh signals

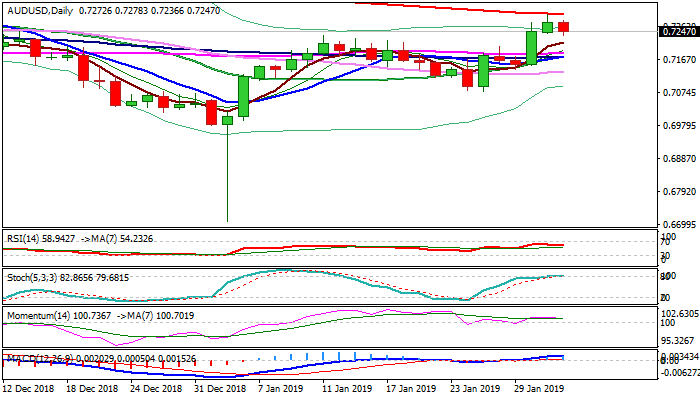

The Aussie dollar stands at the back foot in early Friday’s trading and eases from two-month high at 0.7295, posted after strong bullish acceleration on Wed/Thu on dovish Fed.

Weaker than expected China’s Manufacturing PMI (Jan 48.3 vs 49.5 f/c) added to negative near-term tone after bulls were capped by 200SMA on Thursday.

Deeper pullback cannot be ruled out as daily RSI and momentum turn south and slow stochastic is overbought, but overall picture remains bullish and suggests limited correction for now.

A cluster of converged MA’s (10/20/55/100) at 0.7183/77 zone marks solid support which is expected to contain extended dips and keep bulls in play.

Focus turns towards key event today, US jobs data (Jan NFP 165K f/c vs 312K previous month / AHE Jan 0.3% f/c vs 0.4$ Dec) which are expected to generate fresh signals.

Res: 0.7278; 0.7295; 0.7355; 0.7393

Sup: 0.7231; 0.7205; 0.7177; 0.7133