Recovery attempts show signs of stall

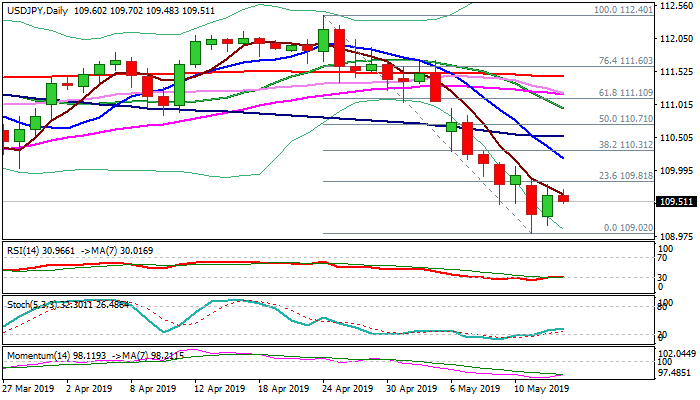

The pair eases in early European trading after attempts to extend Tuesday’s recovery were repeatedly capped by falling 5SMA (109.63) which tracks descend in past two weeks.

Japanese yen remains supported by concerns about further escalation of trade war, with improved sentiment on comments on Tuesday from US President Trump that trade talks with China had not collapsed, so far showing limited positive impact.

Bears show hesitation at key Fibo support at 109.41 (38.2% of 104.57/112.40), as recovery attempts fail to benefit from bear-trap pattern below 109.41 pivot.

Studies on 4-hr chart remain bearish while reversal of daily momentum / stochastic suggests some corrective action.

Falling 5SMA marks initial barrier and limits for now, with extended upticks expected to remain below falling 10SMA (110.17) and daily cloud base (110.31) to maintain bearish bias.

Break below 109.00 handle would open way towards 108.49 (50% retracement of 104.57/112.40).

Res: 109.63; 109.81; 110.00; 110.31

Sup: 109.44; 109.02; 108.49; 108.00