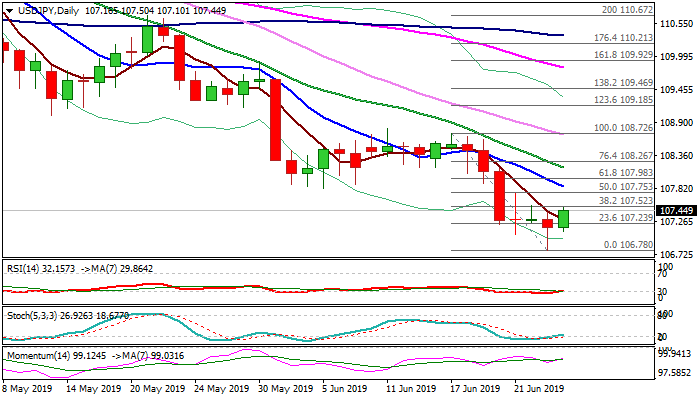

Reversal signal after double-Doji and hammer requires confirmation on close above 107.52 Fibo barrier

The pair bounces higher in Asia / early Europe on Wednesday, after double-Doji (Fri/Mon) and hammer candle (Tue) signaled that bears are running out of steam and market direction may change.

Reversal of daily RSI and stochastic from oversold territory supports the notion, along with dollar’s firmer tone after comments from Fed officials, who said that 0.5% rate cut might be overdone.

Pivotal Fibo barrier at 107.52 (38.2% of 108.72/106.78) is under pressure and break here would provide bullish signal for recovery extension towards 107.75 (50% retracement) and 107.85 (falling 10SMA).

Failure to clear 107.52 barrier would signal extended consolidation, with existing risk of fresh downside attempts as overall picture remains bearish.

Res: 107.52; 107.75; 107.85; 107.98

Sup: 107.23; 107.10; 106.78; 106.43