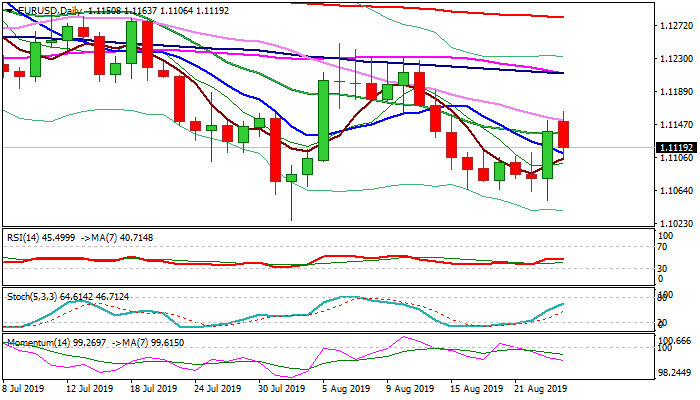

Repeated close below 10DMA to maintain bearish bias

The Euro ticks higher in early European trading on Tuesday after 0.46% fall on Monday, which generated bearish signal on close below 10DMA (1.1108).

The pair was on the roller-coaster in past two days following strong twists in US-China trade conflict story, which became the main market driver.

Fears that German economy is slowing down and persisting political in Italy, keep the single currency under pressure, as data released earlier today showed that German GDP slowed in Q2.

Bearishly aligned daily studies add to negative signals, as momentum remains negative; MA’s are in bearish setup and stochastic turned sideways after rally higher.

Repeated close below 10DMA would further weaken near-term structure and risk retest of Friday’s low at 1.1051.

At the upside, broken 20DMA marks solid resistance at 1.1132, which should cap upticks.

Only lift and close above falling 30DMA (1.1148) would neutralize downside risk.

Res: 1.1127; 1.1132; 1.1148; 1.1163

Sup: 1.1094; 1.1065; 1.1051; 1.1027