Choppy mode ahead of EU response to Johnson’s Brexit plan

Cable jumped to 1.2300 zone after UK PM Boris Johnson outlined his final Brexit plan, which he described as constructive and reasonable and urged the bloc leaders to compromise or face UK leaving on 31 October without a deal.

Johnson added that his plan is not what both sides wanted or looked for, but it is the outcome that both sides are ready for.

Near-term action remains choppy with increased volatility expected on response of the EU later today, which market participants see as key to Brexit endgame.

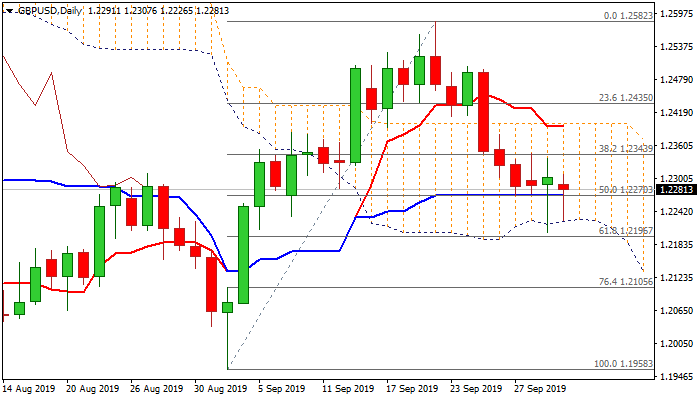

The downside is expected to remain vulnerable on persisting fears of no-deal scenario, which could intensify if the EU refuses to compromise and increase pressure on sterling for final break through cracked pivotal supports at 1.2224/1.2196 (daily cloud base / Fibo 61.8% support).

More constructive tone from the EU would bring fresh optimism and provide relief for sterling.

Break and close above broken Fibo support (1.2343) is needed to generate bullish signal on formation of bear trap pattern on daily chart.

Res: 1.2307; 1.2319; 1.2343; 1.2380

Sup: 1.2270; 1.2226; 1.2204; 1.2196