Bears attack again key support after pausing on Wednesday

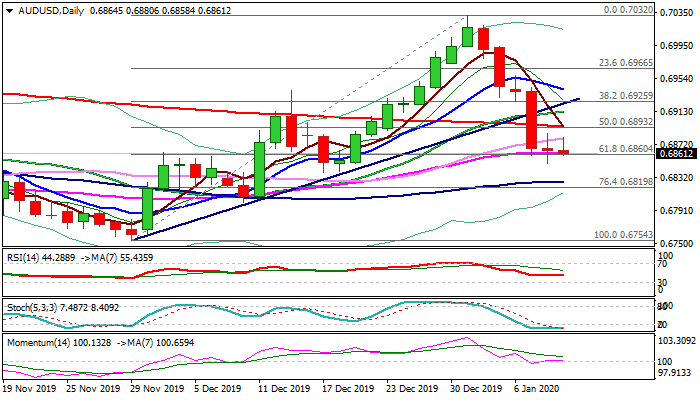

The Australian dollar maintains negative bias in early Thursday’s trading despite Wednesday’s Doji and pressures again cracked pivotal support at 0.6860 (Fibo 61.8% of 0.6754/0.7032 /55DMA) after bears repeatedly failed to close below in past two days.

Negative sentiment on fears of return of catastrophic bushfires, which have made severe damages in past few days in Australia, keeps the Aussie under pressure.

Bearishly aligned daily studies add to negative near-term outlook, as Tuesday’s big red daily candle (the biggest one-day fall since 24 Apr 2019) weighs heavily.

Eventual break of 0.6860 pivot would trigger fresh extension of bear-leg from 0.7032 (31 Dec high) and expose next strong support at 0.6825 (daily cloud top / 100DMA).

Repeated failure to close below 0.6860 would signal prolonged consolidation with limited upside attempts to remain under broken 200DMA (0.6894) and keep bias firmly with bears.

Res: 0.6880; 0.6894; 0.6913; 0.6925

Sup: 0.6860; 0.6849; 0.6825; 0.6800