Pound rises on dovish shift in Fed and fading risk aversion mode

Cable accelerated higher in late Asian/early European trading on Tuesday as dollar softened on rising expectations that the Fed may cut interest rates this year to reduce negative impact from coronavirus epidemic on the economy.

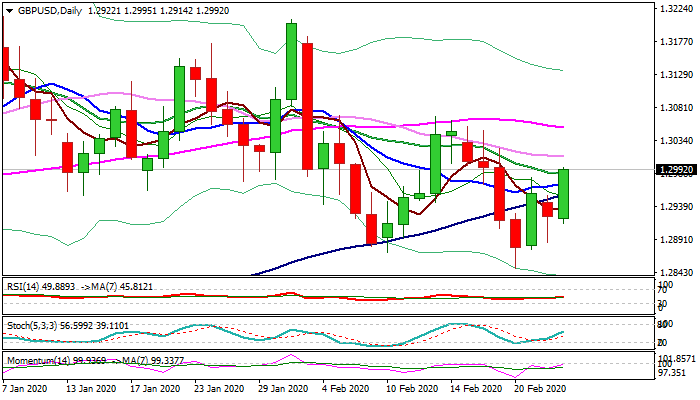

Fresh advance broke above initial barriers provided by 100 and 10DMA’s, cracked 20DMA (1.2986) and pressures psychological 1.30 resistance.

Close above the latter would generate strong bullish signal and expose key barriers at 1.3052/69 (55DMA / 13 Feb high).

Daily indicators turned north and momentum is attempting to break into positive territory that supports scenario.

However, traders remain cautious over key factors that could heavily weigh on pound – rising fears of coronavirus spread into Europe after the virus appeared in Italy and EU/UK trade talks, which are about to start next week.

Res: 1.3000; 1.3011; 1.3052; 1.3069

Sup: 1.2985; 1.2972; 1.2956; 1.2914