Cable may extend pullback on close below 20DMA, weighed by weak UK jobs data / stronger dollar

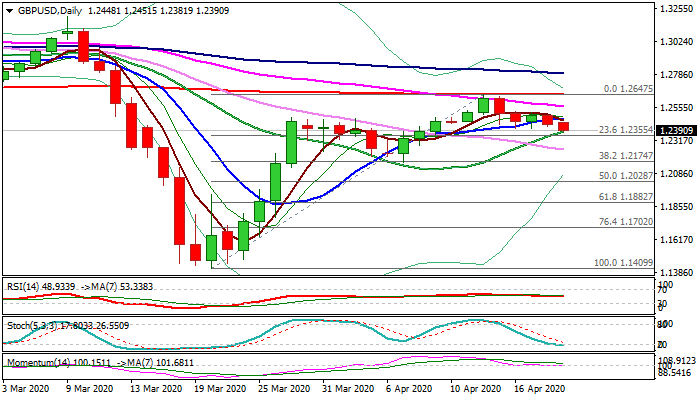

Cable remains at the back foot on stronger dollar and extended weakness to the lowest since 9 Apr to pressure rising 20DMA (1.2382) in early European trading on Monday.

UK jobs data showed that employment growth slowed in March, average earnings fell and unemployment rose, although data do not cover the period when coronavirus lockdown started, signaling that next month release could show worse results.

Also, UK/EU trade talks about their trade relationship after Brexit start today after being halted due to coronavirus lockdown and could also influence pound’s performance.

Daily studies are still mixed and lack clearer signals, however, fundamentals are negative for pound.

Break and close below 20DMA would generate negative signal for extension of pullback from 1.2647 high and expose supports at 1.2254 (30DMA) and key levels at 1.2174/64 (Fibo 38.2% of 1.1409/1.2647 / 7 Apr trough).

Bearish bias is expected to remain intact while 10DMA (1.2471) caps.

Res: 1.2471; 1.2525; 1.2564; 1.2647

Sup: 1.2382; 1.2355; 1.2287; 1.2254